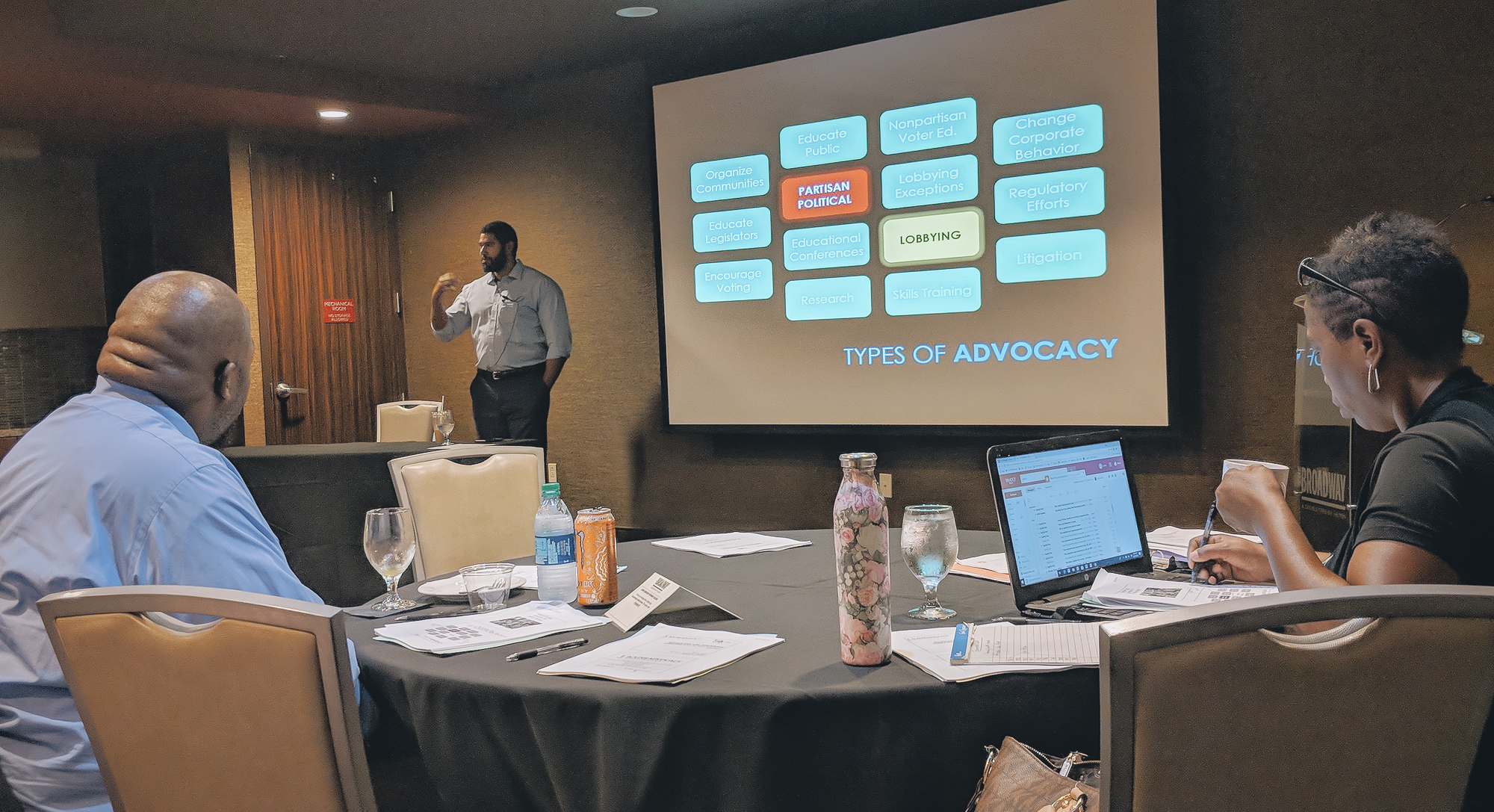

Yes, Nonprofits Should Lobby. Lessons for Managing Risk and Opportunities for 501(c)(3)s from BolderAdvocacy Workshop

Buzzbold is on assignment in Columbia, MO and learning about the rules controlling lobbying and advocacy activities for 501(c)(3) organizations. Missouri Foundation for Health is in its 8th year of providing essential training about lobbying to Missouri organizations under the Alliance for Justice BolderAdvocacy initiatives and today’s presenter, Toren Lewis, Northern California Counsel, is delivering an encyclopaedic level of knowledge on the fundamentals and nuances of these IRS rules.

Fear of Breaking the Rules Limits Your Impact

Generally speaking, 501(c)(3)s can and should advocate for their cause. Use caution to avoid even the appearance of supporting or opposing a candidate for public office. 501(c)(3)s must remain nonpartisan. The IRS limits organizations’ lobbying activities to a small portion of each organizations’ total activity.

The rules about what activities qualify as lobbying are complex, and the ability to advance an organization’s mission through policy depends on knowing how to interpret the rules. Failing to follow the rules comes at too great a cost to risk missteps, for the maximum penalty is loss of the organization’s exempt status. But, if you’re avoiding lobbying out of fear of breaking the rules, you’re probably limiting your organization’s ability to create change.

Context is King

Here in the workshop, we’re hearing about some interesting clarifications and exceptions to the rules, that when leveraged properly could have significant implications for your organization. While there are a few hard-and-fast rules, whether an activity is high- or low-risk depends on how intentionally you’ve planned your activities and the context of communications . Here are a few of our favorite lessons:

- To start, while public charities can lobby, private foundations cannot. Restricted gifts generally can’t be used for lobbying efforts. It may be necessary to clarify whether private foundation-sourced funds are eligible for support lobbying activities.

- By filing IRS form 5768 under a 501(H) election, an organization may be able to spend 4-5 times more on lobbying and grassroots lobbying, and increase clarity about what is and isn’t allowed as opposed to fuzzy definitions under the default “Insubstantial Part Test”. Once electing to 501(H) status, an organization will only report direct costs, staff time, and overhead. Organizations can find out how much of their annual budget may be used for lobbying by using the BolderAdvocacy 501(H) calculator.

- Asking that existing legislation be enforced differently is not considered lobbying. Neither is influencing executive orders.

- Under the Technical Assistance exception, 501(c)(3) organizations may testify and express an opinion on a particular issue or piece of legislation, so long as they are invited in writing on behalf of the entire body. The testimony, whether in person, or in writing, must be available to the entire body.

- Speaking generally about topics not related to specific legislation, such as in brainstorming or whiteboarding sessions won’t count against an organization’s lobbying expenditures.

- The term “Call to Action” has a technical definition in the application of IRS rules. Commonly used web button terms such as “Learn More”, “Take Action”, “Get Involved” are not specific enough to qualify. “Contact your representative and ask them to reject Bill ###” is a clear lobbying Call to Action. An organization can communicate with Members and express views on specific legislation without reporting the activity as lobbying so long as there isn’t a Call to Action.

- Providing “mechanism” for the public or your members to contact legislators will count as lobbying. This includes tools such as email/call your legislator tools in Buzzbold’s WordPress plugins.

Stay Organized and Track Your Efforts

Lobbying even under the 501(H) election requires some deliberate record-keeping. For the whole organization, you should track total hours worked, percentage of time spent lobbying, and percentage of time spent in grassroots lobbying activities. You’ll need to report this information when it’s time to file your 990.

Connect with Experts and Stay Informed of Changes

While there are tons of rules to follow, there isn’t a handbook for managing lobbying activities. Toren’s advice? “Be reasonable and be consistent”. Our advice? Sign up for training and talk to experts! You can call Alliance for Justice for free coaching in navigating the landscape of IRS rules. You can also take advantage of Missouri Foundation for Health’s educational programs such as the one we’re attending today. Reach out to info@mffh.org and ask to be signed up for advocacy resources and workshops email notifications. Expect at least one more session this year!

What are your organization’s creative approaches to advocacy and nonpartisan lobbying? Share your ideas in the comments below!